ITR Refund Status Check – After filing your income tax return (ITR) for July 2024, you can check the status of your income tax refund or demand online on the ITR Refund official website. You can access the ITR Banker Scheme and ITR Refund Tracking Status there. To check your ITR refund status, visit the following link: www.incometaxindia.gov.in. You can check your ITR status using various methods, including your Acknowledgment Number, PAN Card Number, or Aadhar Card Number.

Make sure your ITR has been submitted and verified before checking the status. Income tax refund/demand status for the year 2024 can be checked on the official website www.incometaxindia.gov.in. Taxpayers who have filed their ITR E-Filing Form can now check their refund status. You can verify your income tax refund status online for the years 2021-2022 and 2022-2024 by tracking the ITR refund status at tin.tin.nsdl.com. This service covers ITR Forms 1, 2, 3, 4, 5, 6, and 7. Learn how to check your income tax refund/demand status for 2024 and how to download the ITR status slip for future reference.

ITR Refund Status Check 2024-24

Contents

Every year, all Indian citizens are required to pay taxes to the Income Tax Department. For the year 2024, the deadline for paying your income tax to the government was July 31. It typically takes the Income Tax Department 20 to 45 days to process and provide refunds. However, if an Indian citizen has paid more taxes than required, the government is obligated to return the excess amount. To facilitate this, the government has implemented an ITR refund policy.

Under this policy, any surplus tax amount will be refunded directly to the individual’s bank account. In case any issues arise during the refund process, the Income Tax Department will send the money via a check to the individual’s bank. Many in the audience have questions about how to check their ITR refund status for 2024-24 and the procedure to follow. If you’re interested in finding out where to check your ITR refund status and how to go about it, here’s a quick overview: We have compiled answers to all your queries and will provide detailed information on each aspect. To learn more about the ITR refund timeline and income tax refund login details, please read the entire article.

ITR Refund Status Check Overview

| ITR Notification For | ITR Refund Status Check |

| Complete Name | Income Tax Refund/ Demand Status 2024 |

| ITR Refund Status By | Central Board of Direct Taxes (CBDT) |

| ITR Under | Government of India |

| ITR Form E-Filling Last Date | 31st March 2024 |

| Mode | Online |

| Category | News |

| Income Tax Filling Form Available | ITR Form 1, 2, 3, 4, 5, 6, 7 |

| ITR Refund Status Check For | ITR E Filing Form 2024 |

| ITR Refund Status Check Link | tin.tin.nsdl.com |

| Income Tax Portal | www.incometaxindia.gov.in |

Read Also:-Tripura ByPoll Result 2024

ITR Refund Status 2024-24 Time

To complete the entire ITR refund process, it generally takes the authority around 20 to 45 days. Applicants need to fill out their refund form with accurate details. After electronic verification of your application, the refund will be transferred to your bank account.

The Income Tax Department provides an online tool to track the refund status while it’s being processed. However, if any issues arise during verification, it could cause delays in receiving your refund from ITR. Applicants can also monitor their ITR refund status for 2024-24 after submitting their refund form.

www.incometaxindia.gov.in ITR Status Login 2024

Every year, the income tax department calculates the amount you need to pay. If any citizen pays more than the required tax, they will receive a refund. To receive the refund, Indian citizens must fill out a refund form and submit it on the Income Tax Department’s website. The refund process will then begin. Applicants can also check their ITR refund status for 2024-24 after 10 days of application.

The ITR refund procedure is straightforward. Applicants need to visit the official website, download the refund form, and provide accurate details. Once the authority verifies your form, the excess tax paid will be refunded directly to your bank account. You can find more information about the ITR refund timeline and income tax refund login details.

- Taxpayers have to first visit the ITR Official Website i.e. https://www.incometaxindia.gov.in/Pages/tax-services/status-of-tax-refund.aspx.

- Home Page Click on Tax Payer Login.

- In the new tab, Login Page will Open.

- Enter ITR E Filling Name and Password.

- Fill the Security PIN From Image Appeared.

- Click on Login.

- Now your will be Login Check ITR Account Information by Clicking on My Account Information.

Also Check:-Pm Kisan Balance Check 2024

How To Check ITR Refund Status 2024?

Here’s a simplified guide on how to check your Income Tax Refund Status for 2024:

- Visit the official ITR website: www.incometaxindia.gov.in.

- On the homepage, look for the latest updates on Income Tax Refund Status 2024.

- Click on “ITR Status Login Now.”

- Follow the steps to create a login page:a. Click on “My Account.”b. Then, click on “Income Tax Refund/Demand Status 2024.”

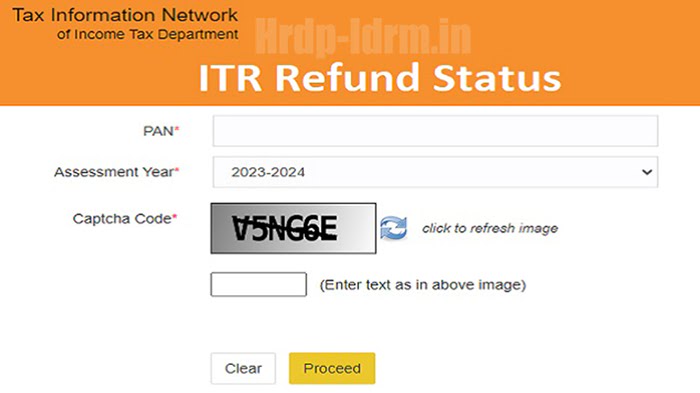

- Enter the required information such as your Acknowledgement Number, PAN Card Number, Aadhar Card Number, and other details as requested.

- Fill in the captcha provided.

- Click on “Get Status.”

- On the screen, you can check your Income Tax Refund Status for 2024.

FAQ’S

How do I check my ITR refund status?

Enter your user ID and password. Navigate to the e File tab and select income Tax Returns then choose View Filed Returns.

How much time it takes to get income tax refund in india 2024?

In this instance, over 6.77 crore income tax returns were submitted, and around 5.63 crore ITRs were confirmed. According to Income Tax regulations, refunds for ITRs are usually processed within 7 to 120 days from the date the return was filed.

When can I expect my ITR refund?

Usually, it takes 20-45 days to receive your refund after filing and verifying your ITR. Now, you've filed your Income Tax Return (ITR) and are waiting for your income tax refund.

Related Posts:-

Ghosi Election Result Winner Name

Dhupguri Election Result Polls

Shilpa is a dynamic and passionate author with a deep-rooted love for technology and storytelling. At the age of 24, armed with a Bachelor’s degree in Computer Science, she effortlessly blends her technical prowess with her creative spirit. Shilpa’s writing transcends the boundaries of imagination, exploring the intersection of science, innovation, and the human experience.